Cyclical – The Only Nature of Different Asset Classes

Gold as an asset class needs no introduction.

Gold, however, is considered a non-productive asset – it doesn’t generate any profits or dividends or rent.

Then why is gold loved so much?

Does that mean investors are being irrational? Certainly not.

Gold is one of the oldest and the most accepted investment options in India and in the world. It is a universal asset meaning it is accepted and traded across the globe. The value of gold doesn’t diminish if we change geographies. This also implies that it is one of the most liquid assets and it doesn’t have currency risk.

Well unlike equities where one may witness extremely sharp stock price movements – the movement in gold prices are relatively less volatile.

The properties of gold don’t change or erode even by a bit even if it is the gold given by your mother/father or grand-mother or great grand-mother or even if it is centuries old. It can pass on from one generation to another generation easily.

Humans have evolved a lot – we have been successful to synthesis diamonds and make them in labs, but we still haven’t been fully successful in synthesizing gold.

Scientists are trying to create real gold in a lab by firing neutrons at metals like platinum or mercury, changing their atomic structure into tiny amounts of genuine gold — but it’s radioactive, dangerously unstable, and costs millions of rupees to produce even a speck using a nuclear reactor. Also, after just a few days, most of it decays back into other elements, making it completely impractical and far more expensive than its actual worth. So, while science has technically achieved the ancient dream of making gold, it’s neither safe nor affordable — proving that Earth-mined gold remains the only practical treasure for now.

Reserves and supplies of gold remain limited. According to world gold council and US Geological survey 216,265 tons of gold has been already mined with around 64,000 tons of remaining reserves. Though there is always a possibility additional reserves getting discovered but the possibility of low-cost gold extraction remains low as it is very difficult to extract gold. So, unlike other metals silver, copper, aluminium where every new mine reserve can lead to increase in supply in the near term the same may not be true for gold.

Gold is also the anti-fiat — when central banks print endlessly, investors flee to hard assets. Post-GFC, fear of inflation, currency collapse, and negative real yields drove institutional and retail demand. The current run-up in gold is backed by demand from central banks and ETF flows, which remains resilient. Global central banks bought gold exceeding 1,000 tonnes annually during 2022 to 2024 primarily led by global uncertainties.

Share of gold vs. the US treasuries in global reserves is a structural change and is unlikely to revert in the near term unless the multipolar global trade system is reinstated back to pre-Trump era. Countries around the world are negotiating bilateral trade deals or carrying out trade with close allies.

US debt has ballooned to unprecedented levels (USD 38 trillion) with no sight of a meaningful course correction. Moreover, the absence of a solution to the debt issue in the US will sustain gold’s haven appeal in the near term. In today’s world where there is uncertainty about the USD being the reserve currency, the possibility of gold becoming the underlying currency becomes a possibility

Equities – Asset class for the long term:

Source: tijorifinance.com

The period from April-2020 to Sept-2024 has made everyone believe that he/she has the potential to be a great investor and that he/she can easily generate 25% CAGR returns from the stock markets.

Well, the Nifty Small cap 250 and Nifty Midcap 150 did generate 26-27% CAGR returns but is that sustainable? Certainly not.

To put this into perspective – 25% CAGR returns p.a. means 25% Pre-tax Return on equity! This means ~20% post tax Return on Equity!

Let’s do a fun exercise on screener and check how many companies in India generate post tax 5-year average ROE of 20% or higher AND have market capitalization of INR 1,000 Crores or higher.

Well, I did that for you, and there are ~1,518 companies which have market capitalization above INR 1,000 Crores and of that only 300 companies were able to generate 5-year average ROE of 20% or higher. That’s only a 20% chance you will be able to generate 25% CAGR returns and 80% chance that you won’t be!

If one thinks generating returns from the stock market is easy, then don’t you think the promoters of balance 1,200+ companies who are not generating 20% ROE would like to sell their stake / existing businesses and handover the money to the equity managers to manage?

Well thanks to the last 1-1.5 years performance – those high returns myth has been busted. There is no easy money in the stock market! NIFTY has generated ~10% returns in INR terms and ~6.5% returns in USD terms. Nifty Midcap 150 has generated ~11% returns in INR terms and ~7.5% in USD terms whereas Nifty Small cap has generated -2% in INR terms and -5.5% in USD terms in last 1 year!

But this is not the correct picture – Nifty50 has not generated positive returns from Sept-24!

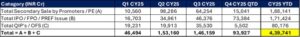

Table showing Net Inflows in Equity Mutual funds incl. ELSS and Index funds:

Source of image: Motilal Oswal

Now let’s compare both the charts and you will see bulk of Mutual fund inflows have been invested during July-2024 to Jan-25 i.e., during the last peak and it’s been more than 1 year since that high has not been breached.

So, majority of the investors are in minor losses / made no returns during the last 1-1.5 year.

So, does that mean one should not invest in equities? Certainly, that’s not what I meant.

Over the last 20 years, NIFTY50 has delivered ~12% CAGR returns, NIFTY Midcap 150 has delivered ~16% CAGR returns and NIFTY Small cap 250 has delivered ~15% CAGR returns. Investors should invest for the long term with moderate return expectations.

Let’s delve into another related point – Has the risk-taking appetite of Indian investors increased?

In my opinion one of the reasons why equities have become the talk of the town for domestic investors is because GSECs have become relatively unattractive.

The returns in Govt. securities are currently around 6.5% (pre-tax). These returns in GSEC are lower than the historical average

Investors used to get GSECs yielding 9-9.5% return in 2013 which have now come down to ~6.5%.

The previous advantage of indexation benefits on debt mutual funds (which invest in G-Secs) has been significantly curtailed, moving these returns closer to the marginal tax rate.

This takes the post tax returns to 4.5-5%.

India has structurally moved from a high inflation high-interest rate economy to low inflation low-interest rate economy. This means structurally more capital flow to other asset classes like equities and real estate to chase more returns.

Well real estate is generally considered a big-ticket investment, illiquid and driven by regional infrastructure development; equities are broad based on the economy, PAT driven, highly liquid and relatively require smaller investment with very low minimum investment criteria.

This makes equities getting preference over other asset classes.

But It’s the risk adjusted returns which matter and should always matter. Risk-adjusted return measures how much return an investment generates per unit of risk taken. It helps compare investments with different levels of volatility or uncertainty—higher returns are expected for higher risk, but risk-adjusted metrics reveal which investment performs better after accounting for the risk involved.

Another reason why Indian investors are investing into equity is due to increased awareness about equity as an asset class. Well, it is truly a remarkable movement for Indian capital markets that equity as an asset class has started gaining recognition.

Unique investor base in India has increased from 3 crore investors in FY20 to 12 crore investors in FY25 – a 4x increase!

The unique mutual fund folios have increased from 2.1 crores in FY20 to 5.7 crores in Sept-25

Equities now account for 6.7% of household assets in FY25 v/s 3.9% of household assets in FY19

The current indicators point towards acceptance of equity as an asset class which is remarkable in itself!

IPO Boom of 2025:

IPO Performance summary – Issue Price v/s Listing Price:

Source: Chittorgarh.com

More than 35% of total issues in CY2025 listed at discount to their offer price. This number in 2024 was only 12.5%. Well, it’s the momentum, valuations and liquidity which drive these listings.

The bankers want to make the most of the underlying momentum, the promoters want to make the most of the valuations they are raising funds at, and the mutual fund managers want new investment options to invest their inflows and liquidity.

90+ mainboard IPOs have already been successfully subscribed in CY2025 YTD and 220+ SME IPOs – THIS IS ROUGHLY 1 IPO PER DAY CONSIDERING 2 MONTHS STILL TO GO!

We did a small analysis of all types of transactions happening in the stock market and these include secondary blocks by promoters, IPO, QIP, OFS, Preferential Issues etc. and we found out that INR 4.4L Crores of liquidity has been absorbed by the markets and is truly unprecedented.

Temporarily markets may even take time to absorb such continuous liquidity, and you may even see sharp corrections at some of these IPO Counters

So, does this mean it’s a bad thing? This has its good side as well.

India was always a capital hungry country since independence. It is finally the coming of the entrepreneurship culture in India where investors are also increasing their risk appetite and providing capital to vision driven and growth driven promoters. I personally believe we will find many new Infosys (Infosys was the startup of the tech boom era!) from this bunch of IPO companies.

Not to forget this will also broaden and develop the capital markets in India.

Cyclical – the only nature of different asset classes:

Investors often forget that every asset class must go through their share of ups and downs.

Some examples where every asset class has witnessed a period of flat or negligible returns.

Assets are cyclical and go through prolonged period of consolidation:

Note: Equities – Nifty 500 Index – TRI, Debt – CRISIL Composite Bond Fund Index; Gold and Silver prices in INR;

Source: Groww multi-asset NFO Product presentation

What should investors do then? To answer it, Multi asset funds are one of the best options for investors

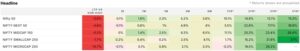

Source: Axis Securities, Data till Sept-30, 2025

- Small cap stocks dominate bull markets, leading the pack in 7 of the past 15 years with explosive gains like 56% in 2023 and 59% in 2021 but they also suffer the deepest crashes in downturns – down by 10% in 2019, down 29% in 2018 and down 34% in 2011

- No single asset class wins consistently, with leadership rotating across gold, small cap, Mid cap, S&P 500, and even bonds highlighting the power of diversification in long-term investing.

- Bonds act as a defensive anchor, delivering the best returns in low-growth years like 2015 and 2016, while equities and gold struggle making fixed income essential for stability.

- Gold shines brightest during crises, topping returns in 5 out of 15 years — including 2025 YTD with an impressive more than 50% gain — proving its unmatched role as a haven when markets turn volatile.

To conclude –

There are multiple asset classes like Domestic & International Equities, Gold, Fixed Income securities, Real estate/REITs etc. and each asset class has its own share of positives and negatives which they bring on the table.

The objective here is not to portray one asset as the best asset class or one asset class being superior than the other; in fact, the objective here was to highlight that each asset class goes through its own period of consolidation, correction & boom; And for a normal investor it is very difficult to catch hold of the timing of such move. Different asset classes perform differently in different economic scenarios. Thus, multi asset funds become one of the many ways to achieve this.

Also, diversification into different asset classes reduces the overall risk of the portfolio.

A diversified portfolio will not only provide better risk adjusted returns but will also provide peace of mind to the investor – meaning the ride will be relatively smoother!